Its a great option if you. Home Partners of America Predatory Low-Quality Business Model that takes advantage of.

Can T Afford A Down Payment Rent To Own Companies Promise To Help

As with a standard lease agreement Home Partners requires you to sign a lease for a year and make a security deposit.

. Generally this means that the home should be a single family home or fee-simple townhome on no more than 3 acres with a minimum of two bedrooms. To qualify for a mortgage with Bank of America youll need a minimum credit score of 620 for Conventional mortgage loans or 600 for FHA loans and a maximum debt-to-income. A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance but this varies depending on the program.

However some states in which Figure provides home equity lines of credit impose a minimum credit score of 680 and Oklahoma homeowners must have a minimum score of 720. We calculate a credit score as the average credit score of all household members who will contribute to rent weighted by the amount each household members income makes of the total income of the household. Homes usually went live.

Now if they would count my self-employment income it would be fine. Even a partial year as shown on my 2015 taxes was about 500 per month and this year has been nearly double that. In addition to answering the Pre-Qual questions we recommend that applicants check that their household meets a metros minimum FICO score.

Home partners of america minimum credit score If you have a credit score below 700 you can take steps to improve your credit. We calculate a credit score as the average credit score of all household members who will contribute to rent weighted by the amount each household members income makes of. Of those folks that dont want to use an agent and decide to attempt to FSBO 70 end up listing with an agent.

Our minimum FICO requirement varies by market. Sounds like it would go something like this - They buy the house you pick you agree to a 2-month security deposit and to rent it for above market rates you then have the option to buy it after a year at 5 above their original purchase price provided you can finance it. Of that 8 35 are closely held transactions between family members.

Call 877-234-5155 for details. Weve put 4 offers on homes going - 20000 over each time. Minimum TransUnion average credit score of 580 or higher.

Gives you the option to buy the home at any point during your. Chicago-based Home Partners of America has purchased over 2 billion in properties and leased them to more than 12500 people who have the opportunity to buy the homes through a right-to-purchase program according to its website. Mortgages are complex forms of financing so a lot of factors come into play when youre applying.

Written By vittetoe30412 Monday July 4 2022 funeral obit ruegg wallpaper ruegg funeral home piedmont obit See prices reviews and available discounts for Ruegg Funeral Homes Inc and othe. Applicants with a score as low as 500 will have to put. Chapter 7 bankruptcies must be discharged before applying.

For credit ratings that are derived exclusively from an existing credit rating of a program series categoryclass of debt support provider or primary rated entity or that replace a previously assigned provisional rating at the same rating level Moodys publishes a rating announcement on that series categoryclass of debt or program as a whole on the support provider or primary. Home Partners of America 180 N Stetson Avenue Suite 3650 Chicago IL 6060 Chicago Illinois USA. Lets you search homes for sale in great communities with quality schools.

Call 877-234-5155 for details. Home Partners will purchase the home for approved residents lease it to the residents and provide a right to acquire it during the lease period at pre-determined prices. FHA loans require a credit score of at least 500 for partial funding and 580 for full funding.

In 2016 there was an all time low for FSBOs at 8. The full credit profile of your entire household is taken into account when they review your application to the Home Partners program. Specific characteristics taken into consideration within each category include APR average interest rate origination fees minimum credit score requirements discounts and customer service.

ET or Saturday from 8 am. A minimum credit score of 660 is required. Home Partners of America Requirements Pre-Application Checklist Application Requirements 90000 STRONG CANDIDATES No pending evictions evictions filings or apartment collections.

Home Partners doesnt focus exclusively on your credit score. Home Partners of America LLC Business Profile Home Partners of America LLC Property Management Contact Information 120 S Riverside Plz Ste 2000 Home Partners Of America Chicago IL 60606-6995. Looking at it from a lenders perspective where you land on.

Weve taken a little break because weve been busy and on vacation and in that last 2-3 weeks Ive noticed a shift in the market. Without that 360 it wont hit the correct qualifying amount and there are no homes cheaper so thats useless. 740 to 850.

Gives you the option to buy the home at any point during your residency up to five years Working together we can find you the right home and put you on the path to becoming a homeowner. But lenders can set their own requirements on top of those established by HUD. It must be located in an approved community and not adjacent to features that may negatively impair value and is listed for between 100000 and 450000 in most states though exceptions apply.

Limits your financial commitment to a one-year lease. Below average or low. When it comes to looking for a conventional mortgage you may need a slightly higher score of around 680.

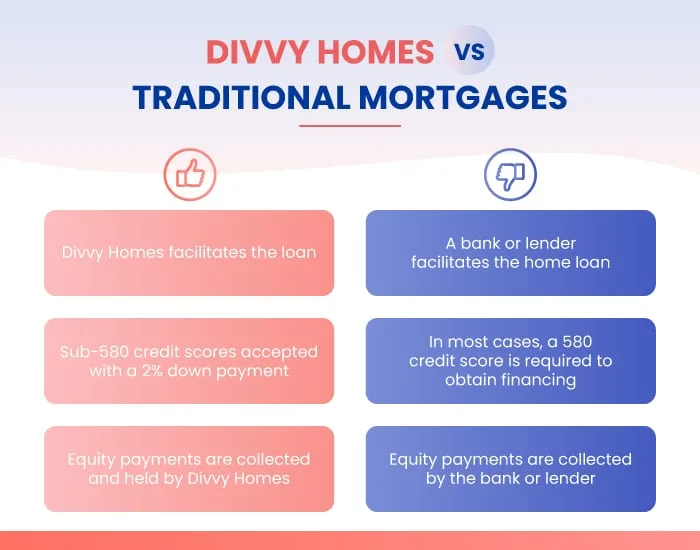

Home Partners provides responsible households that cannot obtain a mortgage a transparent path to home ownership. The last house sold at 60000 over. Find out more about the minimum credit requirements for these types of loansand why your credit score even mattersbelow.

Divvy Homes Good Bad Or Ugly Rethority

Home Partners Of America Reviews Ratings Real Estate Services Near 180 N Stetson Ave Chicago Il United States

Home Partners Of America Reviews Ratings Real Estate Services Near 180 N Stetson Ave Chicago Il United States

Pin By Susannah Jeffs On Team Wods Team Wod Crossfit Workouts Workout

0 comments

Post a Comment